Air Tight News | Winter Edition | December, 2020

Taking Control of Indoor Air Quality

by Starting with IAQ Monitoring

Financial Incentives and Rebates Update

As 2020 draws to a close, state incentive and rebate program administrators are eager to distribute funds they budgeted for the year. What follows are descriptions of program changes and updates.

Mass Save

MA DOER

The MA DOER has a program running that is state-wide and apply in municipalities that do not have gas or electricity from a major utility company.

Whole Home Air Source Heat Pump Pilot Program.

Useful links:

- Mass Save – https://www.masssave.com/en/saving/residential-rebates

- MA DOER Home MVP – https://www.mass.gov/guides/home-mvp

- MA DOER AEC – Alternative Energy Credit – https://www.mass.gov/service-details/qualifying-air-source-heat-pump-in-the-aps

- MA CEC (Clean Energy Center) https://www.masscec.com/get-clean-energy/residential

- Tax Incentives –https://programs.dsireusa.org/system/program/detail/1272 https://www.law.cornell.edu/uscode/text/26/45L

Code Update – MA Adopts IECC 2018

Working with a certified HERS rater remains a key part of the Energy Rating Index (ERI) program, and there are some changes to note to the program that at first glance seem minor but will have an impact on your documentation requirements as well as your ERI Index score. Here is a summary of ERI path changes:

- Changes to buried duct regulations include a clearer definition of buried-duct practices that are explicitly allowed and a simplified credit for buried ducts in the performance path.

- Minor improvement to window efficiency rating: 0.6-1.1% improvement in the prescriptive path.

- Easing of the Energy Rating Index Targets combined with improving thermal envelope requirements when using on-site renewables. For example, energy used to recharge vehicles is excluded from the ERI score.

For details, see https://www.mass.gov/info-details/building-energy-code.

Useful links

- Mass Save – https://www.masssave.com/en/saving/residential-rebates

- MA DOER AEC – Alternative Energy Credit – https://www.mass.gov/service-details/qualifying-air-source-heat-pump-in-the-aps

- MA CEC (Clean Energy Center) https://www.masscec.com/get-clean-energy/residential

- Tax Incentives –https://programs.dsireusa.org/system/program/detail/1272https://www.law.cornell.edu/uscode/text/26/45L

Federal Tax Credit 45L Extension

The Federal Government recently passed an extension of the 45L Residential Tax Credit 2018, 2019 and 2020. You may be able to claim the 45L Tax Credit retroactively thanks to the New Home Energy Efficiency Act. The House signed the bill and the Senate has approved for the 45L tax credits to be allowable retroactively for projects placed in service from 1/1/2018 – 12/31/2020. Taxpayers can now amend their 2018 tax return and apply the $2,000 45L credits to their 2018 tax year, or in some situations file a Form 3115 with their 2019 tax return claiming the credits in the current year.

Background on 45L

The 45L Tax Credit is an energy-efficient tax credit for residential properties. The tax credit is $2,000 per home to the builders and developers of energy-efficient buildings. Qualifying properties include: Apartments, Condos, Townhouses, and Single-family Homes. All eligible properties must be three stories or lower and must incorporate energy-efficient features such as roofing, windows, doors or HVAC systems.

If Ace Energy Services has done a HERS rating for you or your company in the last two years, contact us and we can tell you if each and all the homes you built qualify for the credit. We can provide you with a report which you can submit to the IRS to take advantage of this substantial credit.

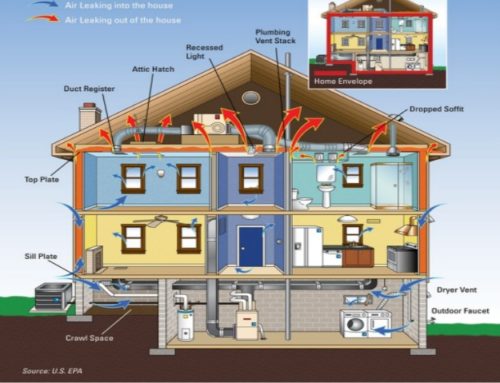

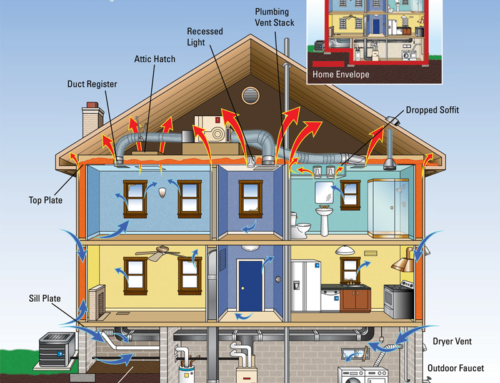

Air Tight Insight is a publication of Ace Energy Services, Inc. a HERS Rating company that puts building science knowledge to work with effective building enclosure air sealing services and by designing and installing high-efficiency air-source heat pumps coupled with smart ventilation systems for single-family, multi-family, and light commercial buildings.

Please feel free to visit our new web site: www.AceEnergyMA.com.